Let's say you've achieved a profit in real estate investment and succeeded brilliantly.However, it is the tax that will increase the weight as soon as it happens.

Incorporation is about to come into view, but I think there are few cases where the advantages and disadvantages of incorporation are understood concretely from the beginning.This time, I would like to tell you the advantages and disadvantages of incorporation for owners who want to consider incorporation.

table of contents

When to Incorporate

What kind of image do you have about incorporation?Taxes will be lower than for individuals, you will be able to deduct various expenses, and you can give rewards to your family.

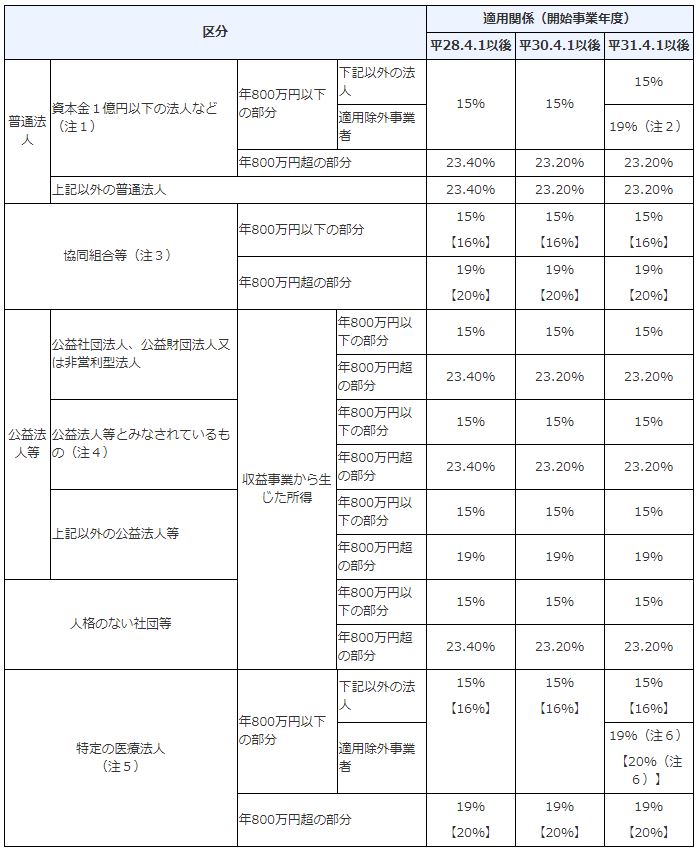

Incorporation is required when taxable income (combining salary income and real estate income) exceeds 900 million yen.Specifically, the income tax for individuals rises as income rises, so the maximum is 45% + 10% inhabitant tax, which is 55%.And the maximum corporate tax is 23% + corporate inhabitant tax + business tax, etc., but it is much cheaper than individual tax.If you refer to the following, you can see that the timing when corporations are cheaper than individuals and corporations is 900 million yen.

195% if less than 5 million yen, 0 yen deduction

More than 195 million yen and less than 330 million yen: 10%, deduction of 97,500 yen

More than 330 million yen and less than 695 million yen: 20%, deduction of 427,500 yen

More than 695 million yen and less than 900 million yen: 23%, deduction of 636,000 yen

More than 900 million yen and less than 1800 million yen: 33%, deduction of 1,536,000 yen

Over 1800 million yen and 4000 million yen or less: 40%; deduction amount: 2,796,000 yen

If over 4000 million yen, 45%, deductible amount 4,796,000 yen

reference:National Tax Agency Income tax rate

Specific calculation method when considering incorporation

Now, let's calculate what the tax amount will be specifically if incorporation seems to be good.

Income tax amount for individuals

Income tax amount when owning property (income tax and resident tax calculated from salary income + real estate income)

+

Transfer tax amount at the time of property sale (sale price - property price at the time of acquisition minus depreciation cost x long-term transfer 20% or short-term transfer 40%)

*Short-term transfer means that the property is sold within 5 years from acquisition.Transfer tax is different for corporations and individuals

Tax amount for corporations

Calculate income tax and resident tax from individual salary income

+

Corporate tax on real estate income

+

Transfer tax amount at the time of property sale (sale price - property price at the time of acquisition minus depreciation cost x 23%)

Comparing individuals and corporationsless tax amountIt is a good idea to select.

Advantages and disadvantages of incorporation

Merit

Officer compensation

You can pay your family members as executive compensation.The advantage is that the taxable income can be diversified and each tax rate can be lowered.

Severance pay

Retirement allowances for executives can be accumulated and treated as expenses, which is effective in reducing taxable income.

Inheritance tax measures

By paying executive remuneration to the heir as an officer, you can effectively inherit without paying gift tax (property transfer).

Inheritance tax is the same as income tax, so the amount of tax increases as the amount increases, so it is possible to transfer property efficiently from the time of life by incorporating it.

Adjustment of depreciation expense and blue return

For individuals, the amount of depreciation is calculated each year according to the formula, but for corporations, it is possible to adjust the depreciation cost and adjust the surplus or deficit according to the situation.If you file a blue return, you can carry forward the deficit for 10 years, so you can use the technique of reducing the tax amount by offsetting it with the deficit of the first year in the year when you made a lot of profit.

* If you do not meet the criteria for being recognized as a real estate business by the tax office, 10 buildings and XNUMX rooms, you cannot carry over.

Demerit

XNUMX.Expenses for establishment and settlement of accounts

Registration and license taxes, fees, administrative scrivener fees, and tax accountant fees for settlement processing are required for establishment (approximately 30 to 40 yen).

XNUMX.There is no special deduction for blue returns like sole proprietorships

There is a deduction of up to 5 yen for business scale (10 buildings and 65 rooms), but there is no deduction for corporations.

XNUMX.You have to pay corporate inhabitant tax even if you are in the red

In the case of a corporation, there is a corporate inhabitant tax per capita rate (minimum of 7 yen) even if it is in the red.

Summary

It is necessary to look at the taxable amount to determine whether to incorporate.If your taxable income exceeds 900 million yen, there is room for consideration.

At Rich Road Co., Ltd., we will consistently support all aspects of investment real estate, from complete beginners to experienced people, from a wide range of real estate selection, loan consultations, post-purchase management, and renovations.