table of contents

Preface

Well, what year is this year?

Speaking of the year of the Tokyo Olympics, it certainly is.

But it's the year of fixed asset revaluation that real estate owners shouldn't forget! (once every three years)

1.What is property tax?

First of all, from the definition of property tax

Q1 What kind of tax is property tax?

Tokyo Metropolitan Tax Bureau

A1 Property tax is levied on owners of land, houses, and depreciable assets (these are called “fixed assets”) as of January XNUMX (the date of assessment) every year, based on the price of the fixed assets. It is a tax levied by the municipality where the fixed asset is located on the calculated tax amount.

However, within the XNUMX wards of Tokyo, the city will impose a tax as an exception.

Taxpayer Those who are registered in the fixed asset tax ledger as owners of land, houses, or depreciable assets as of January XNUMX (the date of assessment) each year.

Tax rate 1.4/100

(Articles XNUMX, XNUMX, XNUMX, XNUMX, XNUMX of the Local Tax Law, Article XNUMX of the Tokyo Metropolitan Tax Ordinance)

The above is a quote from the official website of the Tokyo Metropolitan Taxation Bureau.Property tax is a local tax.In addition, the tax will be levied on a municipality basis, not on a prefecture basis.

We will also post about the city planning tax, which is commonly referred to as the fixed property tax and the property tax.

Q2 What kind of tax is city planning tax?

Tokyo Metropolitan Tax Bureau

A2City planning tax is levied as purpose tax to cover expenses required for city planning business or land readjustment business.

Taxable assets

As a general rule, it is land and houses located in urbanized areas within the city planning area under the City Planning Act (depreciable assets are not subject to taxation).

Taxable person

Those who are registered in the fixed asset tax ledger as owners of land or houses as of January XNUMX (the date of assessment) every year.

Standard taxable value

(1) Land

It is the price that should be the tax base for property tax.

Exceptional tax base measures are taken for residential land.

(a) Small-scale residential land (residential land up to 2mXNUMX per house): XNUMX/XNUMX of the price

(b) Other residential land (residential land beyond (a)): XNUMX/XNUMX of the price

B. We are taking steps to adjust the tax burden in stages according to the burden level.

(2) House

It is the price that should be the tax base for property tax.

Tax rate (within 23 wards) 0.3/100

Method of tax payment Please put in conjunction with property tax.

(Articles XNUMX, XNUMX-XNUMX, XNUMX-XNUMX, XNUMX-XNUMX to XNUMX-XNUMX of the Local Tax Law)

In the above case, the city planning tax is 23% (at present) in the case of the 0.3 wards of Tokyo, but if you go to other municipalities, it really varies. It is 0.25% or 0.275%, or even 0% in municipalities that are rich in tax revenue.

2.What is revaluation of fixed asset appraisal value?

Fixed asset tax is levied on the price of fixed assets, that is, the "appropriate market price" as the tax base.For this reason, reassessment should be carried out every year, and taxation based on the "appropriate market value" obtained from this would contribute to the fairness of the tax burden among taxpayers. In practice, it is practically impossible to review the appraisal of houses every fiscal year. Therefore, in principle, the appraisal value of land and houses remains unchanged for three years. There is a system in place to review

Tokyo Metropolitan Tax Bureau

In this sense, revaluation can be said to be a system to adjust the appraisal value to an appropriately balanced value in response to fluctuations in asset prices during this period.

In XNUMX, the evaluation amount will be reviewed because it is the year of revaluation (base year).

And about the evaluation of land (here we limit ourselves to land)

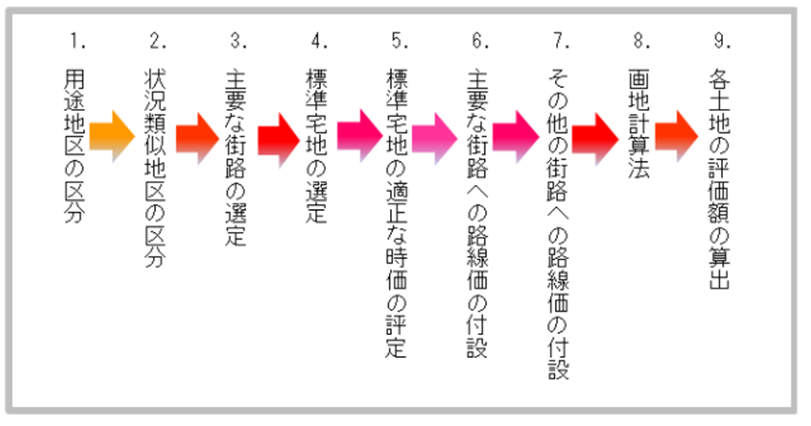

Land located in special wards of Tokyo is assessed for fixed asset tax based on the fixed asset assessment standards established by the Minister of Internal Affairs and Communications, and is based on the Urban Residential Land Assessment Law.This is also known as the so-called land price method, in which a land price representing the price per square meter of standard residential land along the street is attached to each street, and each land is plotted based on that land price. It is a method of applying the land calculation method to find the appraisal value.Specifically, the evaluation process is as follows.

Tokyo Metropolitan Tax Bureau

It is a flow chart.

If you extract the core part of the price calculation ↓

XNUMX Appropriate market value evaluation of standard residential land

XNUMX% of the published price of the land and the price obtained from the appraisal by a real estate appraiser, etc. will be evaluated.

It is listed as 7% of the published price.

3.If you are dissatisfied with your tax

Q10 What should I do if I have a question or an objection about the price (appraisal value) of fixed assets?

Tokyo Metropolitan Tax Bureau

A10If you have any questions about the price (appraisal value) of fixed assets, please contact the Metropolitan Tax Office that has jurisdiction over the location of the fixed assets.

If you are still dissatisfied, you can submit a request for review to the Tokyo Fixed Asset Evaluation Review Committee.

For more information, please refer to the Tokyo Fixed Asset Evaluation Review Committee.

(Article XNUMX of the Local Tax Law)

This is about appeals.

This year is the year of revaluation, so it will be the year when you can appeal against the price once every three years.

And here is the proposed result. ↓

Number of requests for review and status of review results

Afterword

In the above table, if the acceptance is "PriceSince it corresponds to "determining that (assessment price) should be revised", it seems that the initial goal has been achieved.

It seems that there are relatively many houses built in 30, but the reality seems to be quite severe.

<end>